Macau’s economy is facing enormous challenges this year due to the Covid-19 pandemic. The effect is felt throughout all sectors of the economy but more severely in the tourism sector, in hotels, restaurants, travel agencies, and retail, transport-related, and taxi services.

The government announced on February 13 an Economic Stimulus Package that aims to soften the impact of Covid-19 on the economy and provide immediate relief to local companies and residents. This package prioritises measures that provide financial assistance and alleviate cash flow pressures on the Small to Medium Enterprises (SMEs), boost domestic consumption, provide financial support to residents and families in vulnerable situations, and protect employment. The first set of measures against coronavirus outbreak is estimated to contribute to a budget deficit of over 40 billion patacas due to the decrease in gross gaming revenue and an increase in overall government expenses.

On April 8, 2020, the government released the second round of financial measures to cope with the adverse impacts of the pandemic. The second package valued at 10 billion patacas enhances and complements the existing measures issued in the first stimulus package. It aims to assist employees, businesses, self-employed professionals and residents affected by the efforts to contain the virus in a city heavily reliant on tourism.

On May 29, the Administrative Regulation no. 19/2020 was published, regulating the second round of financial measures. This Administrative Regulation establishes the requirements and rules for granting financial support to workers, self-employed professionals and operators of commercial establishments. We have updated the text below accordingly.

To help you navigate and take advantage of these measures, we summarised them in the following way, that includes both rounds of measures:

I. TAX DEDUCTIONS AND EXEMPTIONS MEASURES TO SME AND RESIDENTS

II. LOCAL SMEs FINANCIAL SUPPORT MEASURES

III. RESIDENTS FINANCIAL SUPPORT MEASURES

IV. SHORT CHRONOLOGY OF EVENTS, FOR CONTEXT

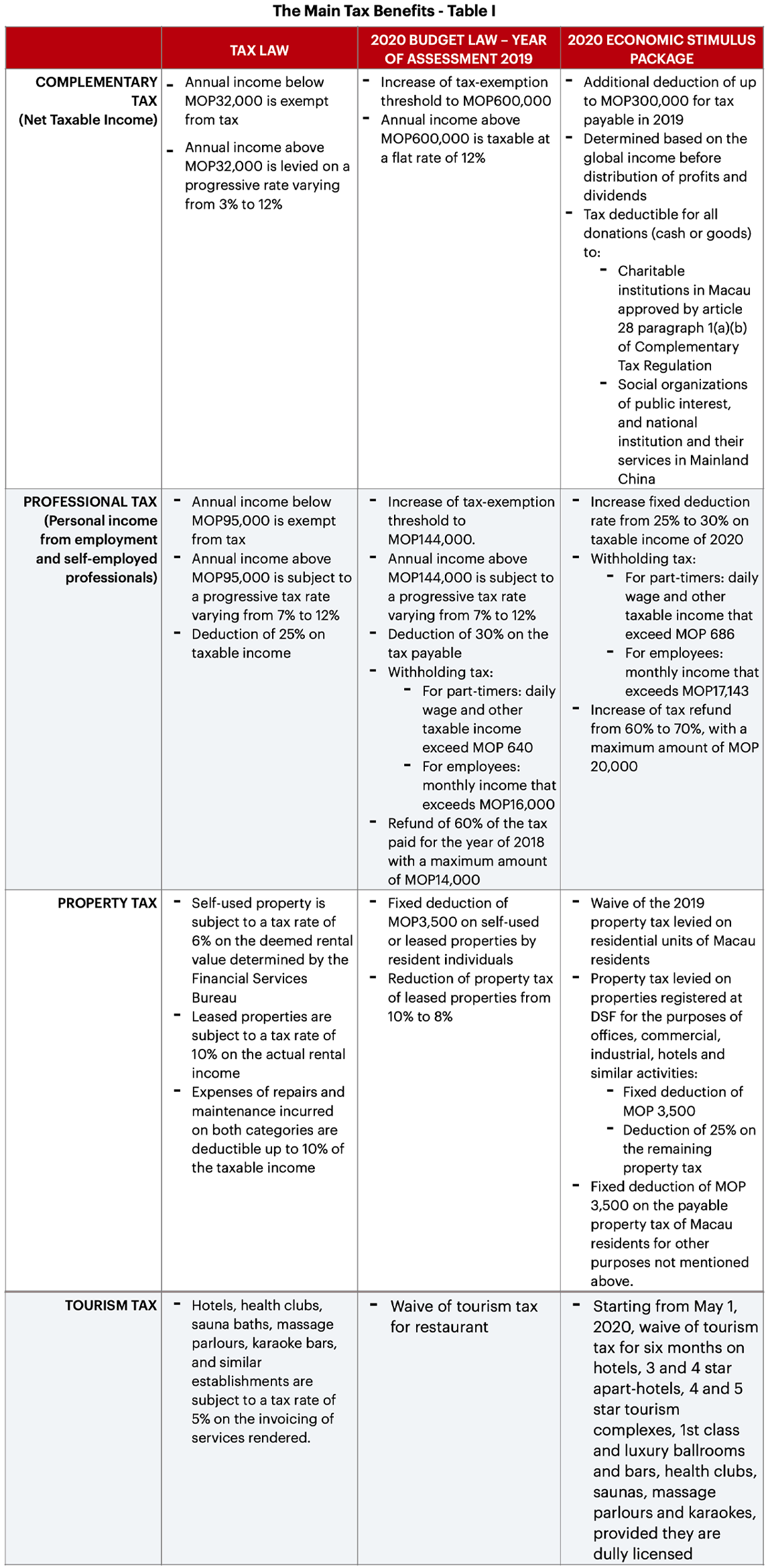

Further to the tax benefits outlined in the 2020 Macau Government Budget approved by Law no. 22/2019 (the “2020 Budget Law”), the government intends to set out a string of tax deductions and exemption measures to cushion the economic impact of the coronavirus crisis. The table below presents the main tax benefits inserted in the 2020 Budget Law and additional tax-related measures unveiled in the Economic Stimulus Package.

Additional tax-related measures include:

Additional tax-related measures include:

– Exemption of the circulation tax paid on commercial vehicles namely buses, taxis, vehicles for transportation of goods, tractors, school vehicles, instruction vehicles, cross-boundary hire vehicles and vehicles registered by hotels, travel agencies and rent-a-car operators or refund of the amount that has already been paid.

– Exemption of stamp duties levied by public departments for the issuing of permits and licenses or refund of the amount that has already been paid.

The SMEs play an essential role in Macau’s economy by providing various goods and services, creating competition, offering innovation, generating employment and contributing to sustainable growth. In times of economic downturn, SMEs find it harder to obtain funding due to their weaker financial structure and lower credit rating.

Thus, to lessen financing constraints, improve access to liquidity and provide immediate relief to local companies, the government maintained the existing support plans, SME Credit Guarantee Scheme and SME Credit Guarantee Scheme Designated for Special Project, changed the requirements to apply for the SME Aid Scheme, launched the SME Loan Interest Rate Subsidy Scheme and a series of other support measures.

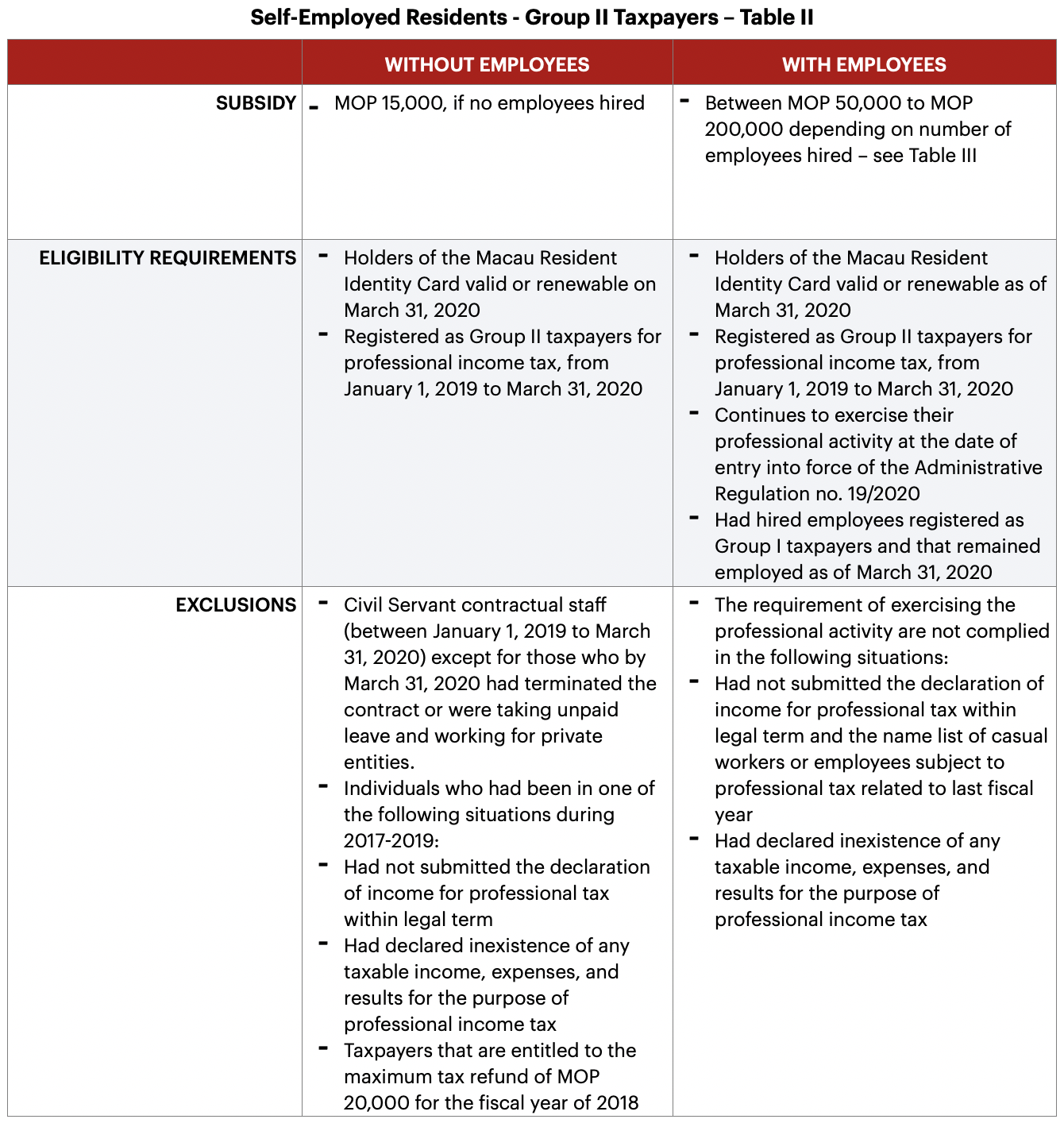

As the situation progressed, further measures were required to help the hardest-hit businesses. A second round of economic stimulus was introduced, including subsidies to provide short-term financial support to self-employed and business and an interest subsidy scheme for self-employed professionals.

– The SME Credit Guarantee Scheme is designed to assist local companies to obtain financing by offering a partial government guarantee coverage equals to 70% of the loan approved by participating banks. The maximum amount of the loan is 7 million patacas corresponding to a guarantee of 4,9 million patacas with repayment period limited to a maximum of 5 years. This plan can be used for any purpose, except for refinancing current loans.

SME Credit Guarantee Scheme Designated for Special Project

– Local SMEs established in Macau for a minimum period of three years can apply for the SME Credit Guarantee Scheme Designated for Special Project. The support plan provides a maximum guarantee of 100% for loans with an amount not exceeding 1 million patacas and a repayment period of 5 years. The loan can be used on special projects related to innovation and restructuring, brand promotion, product quality improvement and new business development. The plan also assists SMEs in short-term financial difficulties due to extraordinary, unpredictable matters or matters that are beyond human control, namely natural disasters and epidemic diseases.

SME Aid Scheme

– The SME Aid Scheme offers interest-free financial assistance of up to MOP 600,000 with a maximum repayment period of 8 years. The existing regulation was amended by the new Administrative Regulation no. 4/2020 published in the Official Gazette, on March 9, 2020, adapted to the current circumstances. Instead of 2 years, companies operating at least one year in Macau can apply for this plan. Moreover, companies that applied for a previous support plan and have not fully repaid that financial assistance can also apply again. The maximum amount granted may be reduced, taking into consideration the amount previously granted.

– Beneficiaries can use the funds for the following purposes: purchase of equipment, renovation, decoration and expansion of business premises, entering into commercial concession or franchising agreements, acquiring rights to exclusive use of technology and intellectual property rights, launching publicity and promotion campaigns, enhancing the operating capacity and competitiveness, use as working capital or to address economic and financial difficulties owing to abnormal, unpredictable or force majeure events.

– The new SME Loan Interest Subsidy Scheme established by Administrative Regulation no. 5/2020 published in the Official Gazette on March 11, 2020, aims to support SMEs in the event of the occurrence of extraordinary, unpredictable or force majeure incidents. Companies that have already secured a bank loan may apply for a maximum of 4% interest subsidy, up to 2 million patacas for three years. Eligible companies must have the loan approved between February 1, 2020, and September 17, 2020.

Reimbursement Adjustment from Previous Support Plan

– Companies that benefited from previous support plans, such as the “Young Entrepreneurs Aid Scheme,” “SME Aid Scheme” and “Special Aid Scheme for SMEs affected by Typhoon Hato,” may request for an adjustment of the reimbursement to reduce their next instalment to a minimum of MOP 1,000. The remaining balance will be divided into equal parts and settle in the remaining repayment periods.

Other Measures for SMEs

Self-employed residents, holders of the following licenses or supporting documents during the period of January 1, 2009, to March 31, 2020, will be entitled to a one-off subsidy of MOP 10,000:

CEOs not eligible to receive this subsidy:

Any self-employed resident and CEO that within six months of the date of entry into force of the Administrative Regulation no. 19/2020:

– Lays off any employees without just cause, will need to return MOP 15,000 for each employee laid-off

– Cease their activity will need to return the full amount received

A consultation system for the eligibility of self-employed professionals and merchants to the financial support will be launched later.

– Self-employed individuals may apply for a maximum of 4% interest subsidy for loans up to MOP 100,000 for two years. The maximum interest rate subsidy is MOP 8,000. Further details will be revealed after the respective legislation to be completed and published.

Banking supplementary options

Besides the Macau government’s financial support measures catered for SMEs, local commercial banks have also launched a number of products, such as:

– BNU, which you can find here

– ICBC, which you can find here

To help find a solution for your particular case, C&C Lawyers will continue compiling other offers in the market.

The coronavirus outbreak has prompted an immediate response to protect the wellbeing of residents, lower the exposure of low-income families to the crisis and raise aggregate demand in the short term.

Apart from that, the government is planning to devote more resources to training programmes. Demand for training will increase during the current situation and is particularly important to help displaced workers to find new job opportunities.

In the second round of stimulus, the government has made available additional resources to alleviate the impact of the virus outbreak on jobs and the economy. Subsidies and another round of consumption vouchers are aimed to provide temporary financial relief to residents and workers (employed and unemployed) to face this difficult time.

The first and second round of measures to address the financial concerns of residents were as follows.

– The annual cash handouts for the Wealth Partaking Scheme will start in April instead of July. Like last year, permanent residents are entitled to receive MOP 10,000 and non-permanent residents MOP 6,000.

– Beneficiaries of regular financial assistance from the Social Welfare Bureau will receive an additional two months-worth of subsidies, the first one during March 2020 and the second one during September 2020.

– All housing units of Macau residents will be exempt from paying water and electricity bills during March, April and May.

– Macau residents will receive on a one-off basis an additional MOP 600 worth health voucher.

– To boost local demand and benefit SMEs in various sector, the government will issue consumption e-voucher via smart card operator Macau Pass with a value of MOP 3,000. The e-voucher can be used on restaurants, retail services, daily necessities or department stores. The card must be spent within three months period from May 1 to July 31 and subject to a daily spending limit of MOP 300. To receive the Macau Pass, residents must register on the website of the Macau Monetary Authority (AMCM) from March 18 to April 8. Residents can collect the card from April 14 to April 30, at the chosen venue out of 32 government premises and 130 local bank branches.

Vocational training

– The government will provide vocational training to local employees, mainly from affected sectors, to help them seize opportunities arising from the government’s commitment to invest in infrastructure projects. These training courses aim to educate electricians, plumbers, welders, carpenters, plasterers, ironworkers, refrigeration and air conditioning technicians, technicians for assembling pre-fabricated items and forepersons for construction sites.

Employees, Group I taxpayers will receive a one-off subsidy of MOP 15,000 (corresponding to three months subsidy of MOP 5,000). The subsidy covers 25% of last year’s median monthly income of MOP 20,000 for residents. Residents can enquire their eligibility to the subsidy here: https://info.dsf.gov.mo/simple.html

Eligibility requirements:

– Holders of the Macau Resident Identity Card valid or renewable as of March 31, 2020

– Registered as Group I taxpayers for professional income tax, from January 1, 2019, to March 31, 2020, even if they are not currently employed

Exclusions:

– Civil servants both permanents and contracted staff (between January 1, 2019, to March 31, 2020) with the exception of those who by March 31, 2020, had terminated the contract or were taking unpaid leave and working for private entities.

– Individuals who had been in one of the following situations during 2017-2019:

– Taxpayers that are entitled to the maximum tax refund of MOP 20,000 for the fiscal year of 2018

Additional Consumption E-Vouchers

– Residents can register for a second e-voucher with a value of MOP 5,000 to be spent between August and December. Considering the first and second round of consumption e-vouchers, each resident will receive MOP 8,000 to support local business.

Paid Occupational Training

– Unemployed residents that attend government training courses will receive a training subsidy of MOP 6,656. The Labour Affairs Bureau will provide job-matching services upon completion of the training program.

– Each employer can enrol up to 5 employees to government training courses to improve their technical and professional abilities. The employer will be entitled to a MOP 5,000 subsidy for each employee that attends the training course during working hours provided that no deduction will be made to the salary of that employee.

Employers may also recommend the employees that are taking no-pay leave to attend the government training courses. Upon completion, the employees will receive a MOP 5,000 subsidy.

The government will continue assessing the adequacy of these measures to ensure the effectiveness of their implementation and ensure appropriate adjustment to the stimulus package as the economy recovers. Some changes along the way are expected according to the feedback of that assessment.

The information contained in this article is based on the information currently available from official sources. Some measures need supporting legislation or regulations that have not yet been approved or made public. We will update this article on our website when legislation is published, or relevant details are available.

To keep informed on these and other matters, make sure to visit our website and subscribe to our newsletter at:

https://www.ccadvog.com/cca/category/newsletter

The response to the outbreak has been very strict but very successful. On February 5, 2020, all casinos and other entertainment facilities such as theatres, gyms, health clubs, cinemas, night clubs, bars, and karaoke were ordered to close for 15 days. Since March 18, all non-residents were banned from entering Macau with exceptions of residents from Mainland China, Hong Kong and Taiwan. On March 19, the government extended the entry ban to all non-resident workers except for residents from Mainland China, Hong Kong and China. Starting on March 25, all residents of Mainland China, Hong Kong and Taiwan who had travelled outside China in the last 14 days were also banned from entering Macau. Macau residents who had travelled to other countries, including Hong Kong and Taiwan in the previous 14 days were required to undergo 14 days of medical observation. All connecting flight were no longer allowed in the Macau International Airport. The commitment to halt the spread of the virus has unavoidably led to the slowdown of all economic activity.

For more information, please contact:

Nuno Sardinha da Mata, Senior Partner | sardinha@ccadvog.com

Sandra Silva, Financial Analyst | sandra@ccadvog.com